Why Your Taxe d’Habitation May Have Gone Up (When it Should Go Down)

For eight French people out of 10, the Taxe d’Habitation has fallen, as expected, by 30%. For others, the tax has decreased slightly and sometimes even increased. Explanations.

For 22 million homes, the taxe d’habitation fell by 30% this autumn . Some French people, who thought they could benefit from this boost at the beginning of the year , had the bad surprise to discover this autumn that this local tax had not diminished. Or worse … it had grown!

Pour bénéficier de la ⬇️de 30% de la #TaxeHabitation, il faut 1 RFR<27 000€/part. Néanmoins, certains facteurs peuvent expliquer une ⬆️de la TH : ⬆️du taux voté par la commune, ⬆️des revenus, perte d’un abattement ou d’1/2 part (départ enfant). Info+>https://t.co/m3B44zbkGV pic.twitter.com/vl8V3SHOXh

— FinancesPubliquesFr (@dgfip_officiel) 10 October 2018

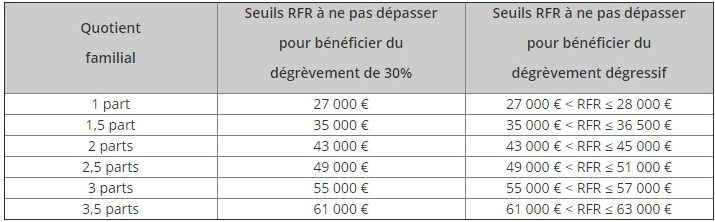

Indeed, tax households that are not affected by the decline are those whose reference tax income reaches and exceeds 27,000 euros for the first part of family quotient. An additional income of 8,000 euros for the next two half-shares and 6,000 euros from the third.

Has your municipality increased tax rates?

According to the Direction générale des finances publiques , some factors may explain an increase in the housing tax. First, if your city has decided to increase the tax burden by increasing the municipal share of the tax rate. This is the case of 5680 municipalities in 2018 (against 12 629 in 2017) and 184 intercommunalities, according to a parliamentary report .

The bill may seem saltier also if you moved to a high-rate city and a larger home in the past year.

Bon bah reçu taxe habitation.

2017: 828€

2018: 1121€Variation en pourcentage écrit sur la feuille: 35,39%

Je pige pas bien pourquoi ils ont communiqué sur: “ça va baisser de 30%?” C’est debile.

Quelque chose m’échappe ? Quelqu’un peut m’éclairer ?

— gaccio bruno (@GaccioB) 9 October 2018

#TaxeHabitation

2017: 586 euros

2018: 592 euros

Je n’ai pas spécialement demandé à payer moins, mais j’ai horreur d’être prise pour une cruche! Par ex payer + quand les medias répètent que ça ↘️

C’est un sévère #Remaniement de politique qu’il faut!— Helene Franco (@LNFranco_FI) 9 October 2018

Abatements may disappear

There is another way for municipalities to increase the housing tax. They can suppress allowances. Not the one for family expenses that is mandatory (which applies as soon as the taxpayer shares his home with his children or his ascendants over 70 years or infirm whatever their age) and that the community can not therefore repeal .

On the other hand, three optional abatements are likely to disappear, precise Le Figaro :

- the general allowance at the base (or flat rate),

- the allowance reserved for persons with income of less than 10,697 euros for one part (2856 euros per additional half-share and whose main dwelling has a rental value of less than 130% of the average rental value + 10% per dependent )

- and the allowance for persons with disabilities (beneficiary of the supplementary disability allowance, the allowance for adults with disabilities, having a disability that makes it impossible to live off work or to hold a disability card).

Gradual removal until 2020

Rest assured, the housing tax will be completely removed by the end of the five-year period, promised Emmanuel Macron. “The rebate of the housing tax will be progressive: 30% in 2018 and 65% in 2019”, explains the website impots.gouv.fr .

“In 2020, the housing tax will be taxed at 100% on the basis of 2017 rates and allowances.”

Enjoyed this? Get the week’s top France stories

One email every Sunday. Unsubscribe anytime.