GAFA Tax: How France Wants the Digital Giants to Pay

After failing to achieve unanimity in Europe on the issue, France presents this Wednesday its bill to tax Facebook, Amazon, Apple, Google and others.

The Minister of Economy Bruno Le Maire presents Wednesday in the Council of Ministers bill to tax the giants of digital, after failing to achieve unanimity in Europe on the issue.

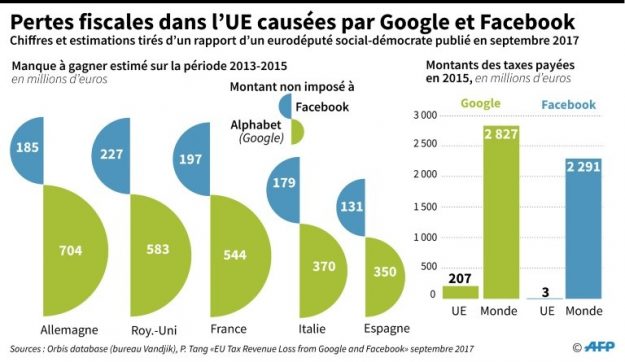

According to the European Commission, their average tax rate is only 9% compared to 23% for European companies in general.

Depending on the turnover achieved in France

“This is an unacceptable injustice,” exclaimed Le Mayor on Tuesday on Radio Classique, and “totally ineffective if we want to be able to finance tomorrow our schools, our nurseries, our hospitals.”

“Non, la France n’est pas isolée sur la taxation des géants du numérique 23 Etats sur 27 y sont favorables ” #GAFA @BrunoLeMaire #ClassiqueMatin https://t.co/4mmCAZk5hP

— 🎼 Radio Classique 🗞️ (@radioclassique) March 5, 2019

As profits are easily transferable to countries where they are less taxed, such as Ireland, the idea is to tax companies on the turnover achieved in a given country.

our recalcitrant countries

In December, in full movement of “yellow vests”, Mr. Mayor had announced that France would adopt its own legislation, lack of European consensus and even if similar tax projects exist in Italy, Spain, Austria, and in the United Kingdom.

Last week he failed to convince the last four recalcitrant European countries (Ireland, Sweden, Denmark and Finland). Unanimity is needed in the EU for tax decisions.

The rate of 3% finally retained in France is similar to that of a European project presented a year ago, but which did not succeed. It concerns companies that make a turnover on their digital activities of 750 million euros worldwide and more than 25 million euros in France.

For the whole year 2019

The scope of the tax covers three activities: intermediation, that is to say the platforms that send the user to a third site (but not the sales made by a brand via the Internet on its own site), advertisements online and the sale to third parties of personal data.

Thus Apple will not be subject to the tax on sales of computers or smartphones, but for the AppStore, its mobile application store made by third parties.

Finally, the tax will apply to the whole of 2019, even if the text should only be presented in April at first reading in the National Assembly.

500 million euros

On Friday, M. Le Maire presented his text to representatives of companies in the sector, including professional organisations France Digitale, Tech in France and the Union of Internet boards.

In particular, American groups Amazon, eBay, Facebook, Google, as well as the French Criteo, Blablacar, Cdiscount, Orange, Stayed, without their presence implies that they are subject to the tax.

It must pay 500 million euros. “Thirty groups will be affected,” said the Mayor in Paris on Sunday. But according to an industry source based on estimates of the tax services, a hundred companies could be concerned.

Questioned by AFP, Tech in France, which represents software publishers, regrets that “competitors who pay their corporate tax in France are also affected by this tax and will be penalised”.

“A lot of noise for a very limited measure”

This organisation also asks for details of the tax base for platforms “whose turnover includes third-party trading”, such as in the sale of airline tickets, where margins are low and volumes are high.

The platform paradises tax and judicial, which includes many NGOs, denounces it “a lot of noise for a very limited measure,” noting that the digital sector “is not the only one to play with our outdated tax system.”

The turnover tax is also presented as a second-best solution pending OECD tax harmonisation, which US Treasury Secretary Steven Mnuchin supports in principle.

European interests

M. . Le Maire hopes for this to achieve “a common European position to defend within the OECD”.

“The fact that the United States is going to start will create an unprecedented dynamic,” according to Jean-Pierre Lieb of EY.

This lawyer believes, however, that the Americans may want to extend this new type of taxation hitting more consumption than production to areas that would affect European interests, from cars for Germans to luxury for the French.

Enjoyed this? Get the week’s top France stories

One email every Sunday. Unsubscribe anytime.